Paper Trading: The Essential Guide for Traders to Build Skills Without Risk

Most aspiring traders don’t fail due to a lack of strategy or ambition—they fail because they jump straight into live trading unprepared.

Trading is a multifaceted skill that requires time and deliberate practice to master. New traders must learn the basics, like identifying the setups they want to trade, defining their risk tolerance, determining holding times, and figuring out their ideal trading frequency. Each of these elements takes time to understand and align with one’s personality and goals.

However, when you add the pressure of risking real money, the learning process becomes far more challenging. You’re not just trying to develop technical skills—you’re also managing emotions like fear, greed, frustration, and the temptation to act impulsively.

These psychological challenges can derail even the most disciplined individuals. Without a solid foundation or a way to practice risk-free, many traders quickly find themselves overwhelmed, burning through capital before they’ve truly learned what works.

What is Paper Trading and Why It's Essential for Trading Success

Paper trading is the practice of simulating real trades without using actual money. It allows traders to test strategies, learn market mechanics, and refine execution—all in a risk-free environment. Instead of risking capital, traders use virtual funds to enter and exit positions based on live or historical market data.

Why Paper Trading Is So Important

Many aspiring traders dive into live markets too soon, only to be overwhelmed by emotional decision-making, inconsistent results, and costly mistakes. Paper trading solves this by removing financial pressure, allowing you to focus on mastering your process.

It's not just for beginners—intermediate and advanced traders use paper trading to:

- Backtest new setups before going live

- Adapt to new market conditions

- Rebuild confidence after a losing streak

Key Benefits of Paper Trading

- Risk-Free Learning – Gain market experience without the fear of losing money

- Strategy Testing – Experiment with setups, timeframes, and risk models safely

- Discipline Building – Practice following your rules without emotional interference

- Confidence Boosting – See your system work before going live with real capital

- Emotional Mastery – Learn to separate process from outcome and build resilience

Whether you're brand new or preparing for a funding evaluation, paper trading gives you the space to grow into the trader you want to be—without paying tuition in real losses.

Why Paper to Trader Is the Best Paper Trading Platform for Futures Traders

Paper to Trader bridges the gap between learning and live trading by providing a risk-free paper trading environment that helps you build real trading skills. Unlike basic simulators, Paper to Trader uses live market data, replicating price action, volatility, and order flow so you can experience how the markets move — without risking your capital.

This means you’re practicing under the same conditions you’ll face in live trading, giving you an edge when it’s time to make the transition. It’s the ideal paper trading platform for futures traders who want to train with precision, confidence, and purpose.

Features That Prepare You for Live Markets

- Live Market Data – Practice using real-time price action, spreads, and volatility

- Advanced Charting Tools – Analyze markets in detail and identify setups

- Built-in Trade Journal – Track performance and uncover patterns

- Custom Risk Parameters – Set your own drawdown rules and position sizing

- Unlimited Practice – No financial pressure, unlimited resets

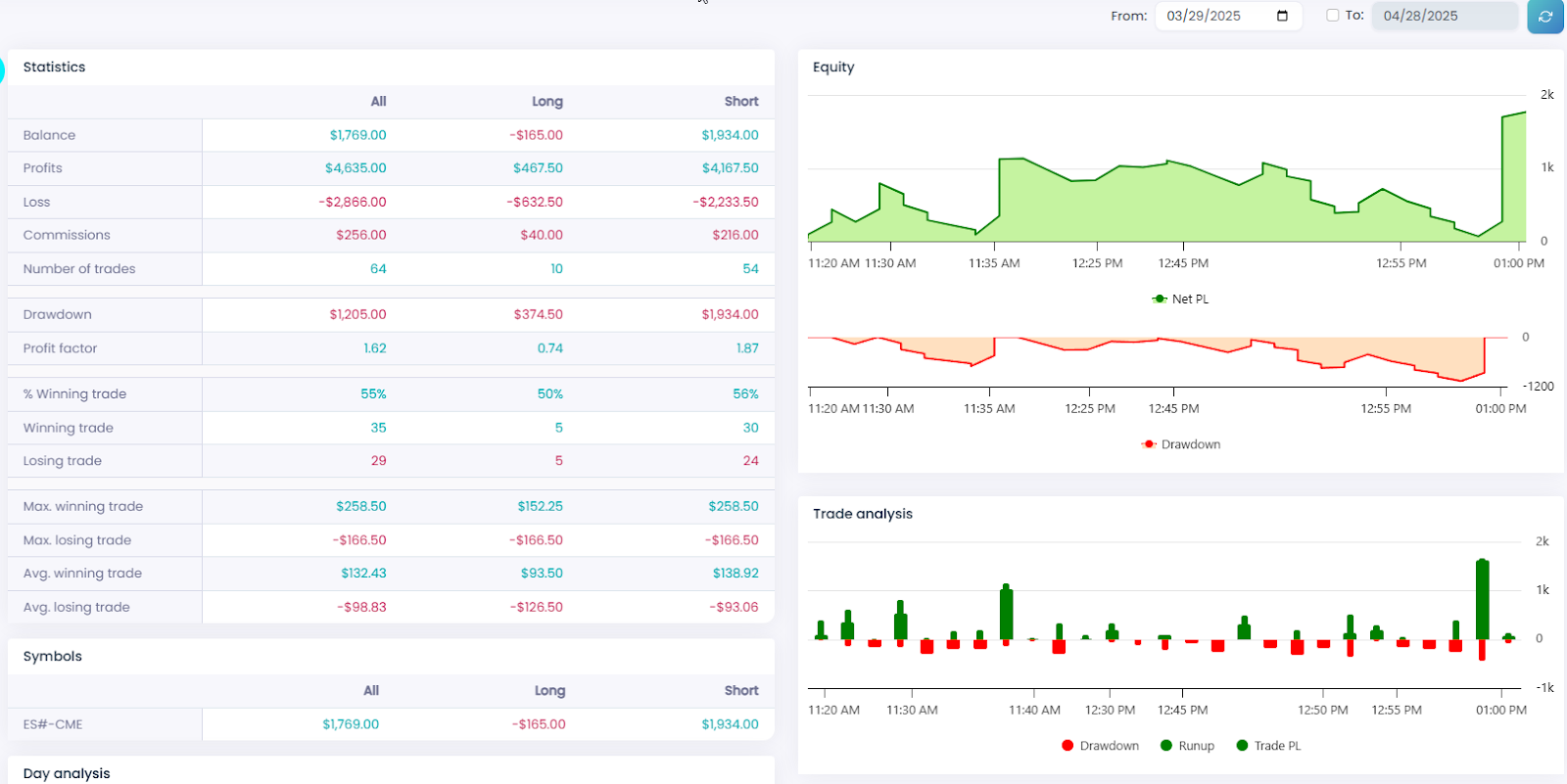

The platform includes advanced charting tools to help you analyze markets and identify high-probability setups. Its built-in trade journal tracks your trades and stats, helping you pinpoint strengths, weaknesses, and behavioral patterns.

You can also set custom rules and drawdown limits to practice proper risk management — a core element of long-term success.

By combining these features into one streamlined paper trading platform, Paper to Trader gives you the tools to refine your edge, sharpen decision-making, and eliminate impulsive habits — all without risking real capital.

Whether you're preparing for a funding evaluation or just want to trade like a professional, this platform helps you build the confidence, discipline, and consistency to succeed in live markets.

Paper Trading Simulator for Risk-Free Skill Development

One of the greatest advantages of using a paper trading simulator like Paper to Trader is the ability to learn and experiment without the pressure of risking real money. For new and experienced traders alike, this free paper trading environment offers:

- The freedom to test setups, strategies, and trading styles (including order flow trading)

- The ability to make mistakes and learn from them — without financial consequences

- A low-pressure way to fine-tune your approach with growing confidence

By removing the emotional weight of losses and gains, a simulated paper trading account helps you:

- Practice objective decision-making

- Build consistency

- Develop the discipline needed to succeed when transitioning to a real trading account

Unlimited Resets to Fine-Tune Your Strategy

A significant challenge traders face when using traditional funding evaluation programs is the cost of resetting after making mistakes. Each failed evaluation can result in hefty reset fees, which quickly add up and put unnecessary financial pressure on traders.

This pressure often forces traders into poor decision-making, as they feel rushed to pass the evaluation and recover their losses.

Paper to Trader eliminates this issue by offering unlimited resets at no extra cost. Traders can:

- Experiment freely

- Refine their strategies

- Learn from mistakes — without the burden of paying for every misstep

This unlimited reset feature encourages a growth-oriented mindset, allowing traders to:

- Focus on performance, not penalties

- Test multiple strategies

- Fine-tune their approach to real market conditions

By removing financial penalties, Paper to Trader helps traders:

- Build consistency, discipline, and confidence

- Develop a repeatable process

- Hone essential long-term skills

In essence: Every failure becomes a stepping stone toward growth — preparing you for live markets without breaking the bank.

Customize Your Paper Trading Risk Parametes

Traditional funding evaluations often come with rigid risk rules — like daily loss limits, position sizes, or max drawdowns — that may not align with your natural trading style.

Whether you're preparing for a funding evaluation or simply looking to improve as a trader, Paper to Trader gives you full control to set your own risk parameters. You can tailor your rules to match your approach — whether you're a scalper, swing trader, or long-term position holder. This flexibility allows you to practice under your own conditions and refine your strategy without risking real capital.

For those aiming to pass funding programs, Paper to Trader lets you replicate specific rules of your chosen evaluation. For traders focused on personal growth, it’s a chance to design risk settings that match your:

- Goals

- Risk tolerance

- Trading style

You can also experiment with:

- Position sizes

- Stop-loss levels

- Daily drawdown limits

Ultimately, managing risk effectively is the foundation of any successful trading journey. Paper trading with Paper to Trader encourages this discipline early, helping traders build confidence, consistency, and control — before ever trading with real money.

Build Consistency and Confidence with Paper Trading

Consistency and confidence are essential traits of successful traders, but they take time and deliberate practice to develop. With a structured environment like Paper to Trader’s trading simulator, you can focus on building a winning routine.

This includes practicing key habits such as:

- Logging trades

- Adhering to rules

- Managing emotions during both wins and losses

These practices form the foundation of professional-level trading and are key to achieving long-term success.

One of the platform’s standout features is its ability to reinforce success. Consistently following your process and seeing positive results over time builds trust in your strategy and your ability to execute it effectively.

In this risk-free paper trading environment, you can focus entirely on refining your approach without being distracted by financial pressure — helping you develop objectivity and a steady mindset.

Equally important is the ability to practice handling losses. A simulated paper trading account gives you space to:

- Experience setbacks

- Analyze what went wrong

- Adjust your strategy — all without the stress of losing real money

This not only sharpens your problem-solving skills but also strengthens emotional resilience, which is critical when transitioning to live markets.

By mastering these skills in a simulated setting, you’ll create a repeatable process that fosters consistency and confidence — two hallmarks of successful traders.

Realistic Paper Trading Simulation for Live Market Preparation

One of the most critical aspects of preparing for live trading is practicing in an environment that closely mirrors real market conditions.

Paper to Trader provides a highly realistic paper trading simulator, replicating live spreads, volatility, and order fills.

This true-to-life experience ensures that traders can develop their strategies and skills in a setting that feels as close to live trading as possible.

Unlike oversimplified paper trading platforms, Paper to Trader incorporates the nuances of market movement — giving traders a deeper understanding of how markets behave in real time.

This realistic approach is especially valuable when transitioning from practice to a live account. Many traders are caught off guard by the dynamics of real markets, such as:

- Sudden price fluctuations

- Slippage

- Partial order fills

Paper to Trader eliminates these surprises by exposing you to them early — helping build the confidence and adaptability needed for success.

By practicing in an environment that accurately reflects live trading, you can:

- Refine strategies under realistic conditions

- Gain a better sense of what to expect when real money is on the line

Whether it’s managing volatility or executing trades efficiently, this level of preparation ensures you’re ready to perform consistently when you make the leap from a paper trading account to real markets.

Master the Mental Game: Where Confident Trading Begins

Trading success isn’t just about strategies and technical skills — it’s about mastering your mindset. In live markets, fears like losing capital or missing opportunities can trigger impulsive decisions that derail even the best plans.

Paper to Trader eliminates this emotional weight, allowing you to focus on process improvement instead of monetary pressure. When you're free from fear-based distractions, you can stick to your trading plan, follow your rules, and make decisions without second-guessing.

This emotion-free environment helps you build the mental consistency that winning traders rely on — patience, discipline, and objectivity. As Mark Douglas, author of Trading in the Zone, said:

“The consistency you seek is in your mind, not in the markets.”

Paper to Trader is designed for exactly that — giving you a place to train your mindset and sharpen your edge before money is ever on the line. It promotes a shift from focusing on profits to mastering the process, helping you:

- Develop strong, repeatable habits

- Practice staying emotionally balanced

- Build confidence through consistency

Unlike high-pressure evaluations, this realistic paper trading platform offers:

- Unlimited resets

- Customizable risk parameters

- Simulated market conditions that closely mirror live trading

Whether you’re just starting out or leveling up, Paper to Trader is the smartest first step. It’s where consistent, confident traders are made — and where your professional journey can truly begin.

Start today with a practice trading account, and build the mental and technical foundation to trade with clarity, discipline, and confidence tomorrow.