How to Pass a Prop Firm Evaluation: Guide for Futures Trading Success

Passing a trading evaluation is a pivotal step for aspiring funded traders. Yet it often feels overwhelming — especially when facing the rigid rules and emotional pressures built into most prop firm trading tests.

Evaluation companies are designed to measure not only your trading skills, but your ability to manage risk, stay disciplined, and maintain consistency under pressure.

Many traders fail due to:

- Strict daily loss limits and max drawdowns

- A lack of proper preparation

- Emotional stress from high-stakes trading

- Costly reset fees that pile up after mistakes

Paper to Trader transforms this experience. By offering a realistic, risk-free environment with unlimited resets at no extra cost, Paper to Trader helps you refine your strategies, sharpen your skills, and build confidence — without financial penalties.

Let’s dive into how this platform prepares you for success with futures trading prop firms and beyond.

Understanding Prop Firm Trading Evaluations: Common Challenges and Requirements

Trading evaluations are intentionally tough. You’re pushed to show skill, discipline, and consistency while adapting to rigid rules like daily loss limits, maximum drawdowns, and strict profit targets.

These restrictions often clash with a trader’s natural style, forcing uncomfortable adjustments that lead to mistakes.

Beyond the technical challenges, there’s a constant financial pressure. Every failed evaluation brings costly reset fees, which can discourage experimentation and amplify stress.

For many, the emotional weight of needing to pass creates a cycle of impulsive decisions, mounting mistakes, and stalled progress.

Without proper preparation, even highly skilled traders find themselves struggling to meet evaluation standards.

Unlimited Resets: The Key to Mastering Prop Firm Trading Without Financial Pressure

One of the biggest advantages of using Paper to Trader is the ability to practice freely — without the looming threat of reset costs. Unlike traditional evaluation companies that charge fees for every failure, Paper to Trader offers unlimited resets at no extra charge.

This feature allows you to:

- Experiment with different strategies

- Learn from mistakes without setbacks

- Refine your approach through trial and error

More importantly, it shifts your mindset. Instead of fearing failure, you’re encouraged to focus on learning, adapting, and mastering your skills over time. Building true trading consistency takes patience — and Paper to Trader gives you the space to grow without punishment for every misstep.

When it’s finally time to take on a live evaluation, you’ll approach it with confidence, experience, and a much higher likelihood of success.

Customizing Risk Settings to Match Futures Trading Prop Firm Requirements

Every futures trading prop firm sets its own rules around risk — from daily loss limits to maximum drawdowns. These preset parameters often feel unnatural to traders, forcing them to adjust quickly and perform under unfamiliar restrictions.

Paper to Trader solves this problem by letting you customize your trading conditions to mirror the exact rules of the evaluation you're targeting. You can set:

- Daily loss limits

- Maximum drawdowns

- Position sizing rules

This flexibility means you can practice under the same pressure and expectations you’ll face during a real evaluation. Instead of hoping you’ll adapt when it counts, you’ll already have the discipline built into your trading routine.

By mastering evaluation-specific risk management in advance, you dramatically increase your chances of passing on your first try.

Realistic Market Simulations: Essential Preparation for Prop Firm Trading Success

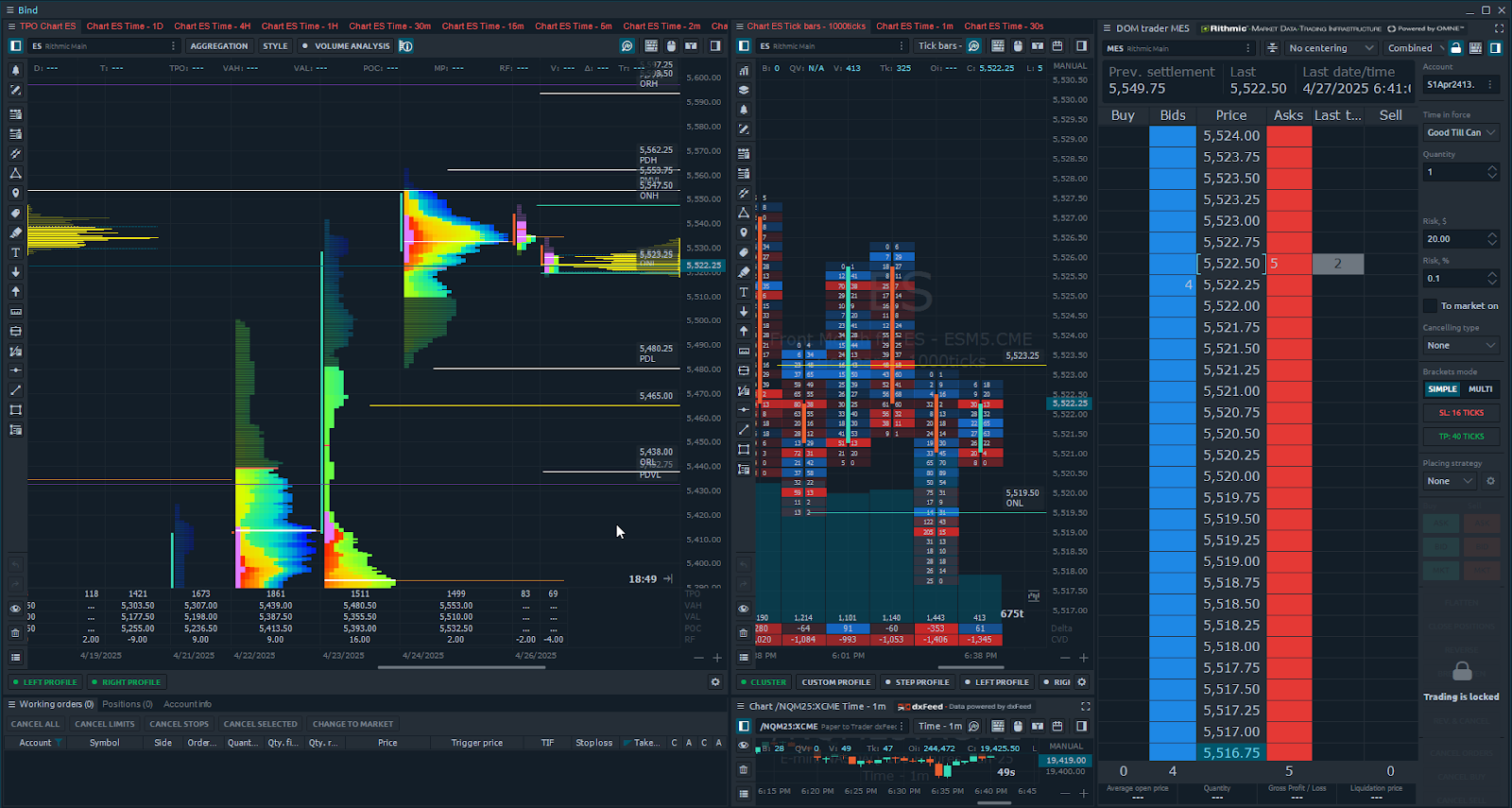

Paper to Trader isn’t just a basic simulator — it mirrors the dynamics of real markets. Using live market data, it replicates:

- Accurate spreads

- Volatility spikes

- Slippage and partial fills

Practicing under these real-world conditions prepares you for the unexpected — the sudden market movements or execution challenges that trip up so many traders during evaluations.

By adapting to these realities in a risk-free environment, you develop better timing, better decision-making, and greater resilience. You won't be surprised when the real market throws a curveball — you’ll be ready for it.

Emotional Mastery: The Hidden Key to Passing Prop Firm Evaluations

Technical skills alone aren't enough to pass a prop firm evaluation. Emotions — fear, greed, frustration — are what usually cause traders to break their rules and sabotage their own success.

Paper to Trader creates a powerful training ground where you can:

- Practice making objective decisions

- Handle losing streaks without panic

- Stay calm during winning streaks without overconfidence

By removing real financial risk during practice, you can train your emotional discipline — so when it's game time, you're not rattled by pressure. Emotional mastery is the true separator between traders who pass evaluations and those who don't.

Track Your Performance: Knowing When You're Ready for a Futures Trading Prop Firm Test

Blind confidence isn’t enough. To pass an evaluation, you need measurable progress. Paper to Trader includes a comprehensive trade journal that tracks:

- Win/loss ratios

- Profitability trends

- Risk management metrics

By analyzing your data, you’ll see where you're strong, where you’re vulnerable, and when you’re consistently meeting your evaluation’s goals.

Instead of guessing, you’ll know exactly when you're ready to take the real evaluation — saving time, money, and frustration.

How to Pass a Prop Firm Evaluation and Get Funded: Your Path to Success

Passing a prop firm evaluation is one of the biggest milestones in a trader’s career — but it’s not about luck or shortcuts. It’s about preparation.

Paper to Trader removes the biggest barriers by offering:

- Unlimited resets for fearless practice

- Customizable risk settings to match real evaluations

- Realistic market simulations for live trading experience

- Emotional training to stay calm under pressure

- Performance tracking to know exactly when you're ready

If you’re serious about how to pass a prop firm evaluation, Paper to Trader gives you the structure, tools, and experience you need to make it happen.

Start practicing like a professional today — and trade with confidence tomorrow.